LLC (shortened for limited liability company) stands on top as the most preferred type of business in Delaware. An LLC has the utmost flexible structure. The maintenance is easy. There are very few compliance requirements. It is not taxed at the entity level. Hence, double taxation is avoided. You are highly recommended to register an LLC in Delaware to start your business in the U.S.

“But how to register an LLC in Delaware?” is the question you may ask. The process is super simple. In fact, you can do this in only 3 steps. This blog will show you exactly just that and subsequently instruct you on what to do after the LLC registration.

1. Preparation for a Delaware LLC Registration

You can create a Delaware LLC even though you live in another country. You only need to submit one registration form to the government. No other documentation is required for an LLC registration

There is just one requirement. You have to get and maintain a registered representative/agent in Delaware for your LLC.

The agent can be an individual or entity, but must be resident in Delaware. You can think of a registered agent as a point of contact for your LLC. The agent will receive tax notices and other legal documents on the behalf of your LLC.

If you aim for an incorporation service for your Delaware registration, then you don’t need to worry. Almost all service providers can easily help you fulfill this requirement.

Note: If your LLC has a business office in Delaware, it can act as its own registered agent.

2. How to Register an LLC in Delaware

You can set up a Delaware LLC by yourself or engage an incorporation service. The latter option is highly recommended (especially for foreigners). An excellent service provider helps you submit the correct form to the government. They can also later assist you in designing your LLC’s internal document (e.g. the Operating Agreement, which will be discussed later in this blog). A good service will make sure that the process stays on the right track.

Generally speaking, it is pretty easy to form an LLC in Delaware. You can follow the following 3 steps for Delaware LLC formation.

Step 1. Choose the Name for Your Delaware LLC

Based on the Delaware Code (local law), here are some guidelines for you to name the LLC:

- The name must include the suffix “limited liability company”, or “LLC”, or “L.L.C”.

- The name can include your name or another member’s name.

- The name must be distinguishable. It should not be the same as other businesses. Also, it should not be confused with the name of any government agency.

It is always a good practice to check the availability of your LLC name in advance (via the government’s name check service). You should also check the availability of the domain for your company’s website (if you tend to build one).

Once the name is approved by the Secretary of State, it can be reserved for 120 days. You can further extend the reservation for another 120 days (subject to an additional fee).

Step 2. Submit a Delaware Certificate of Formation for LLC

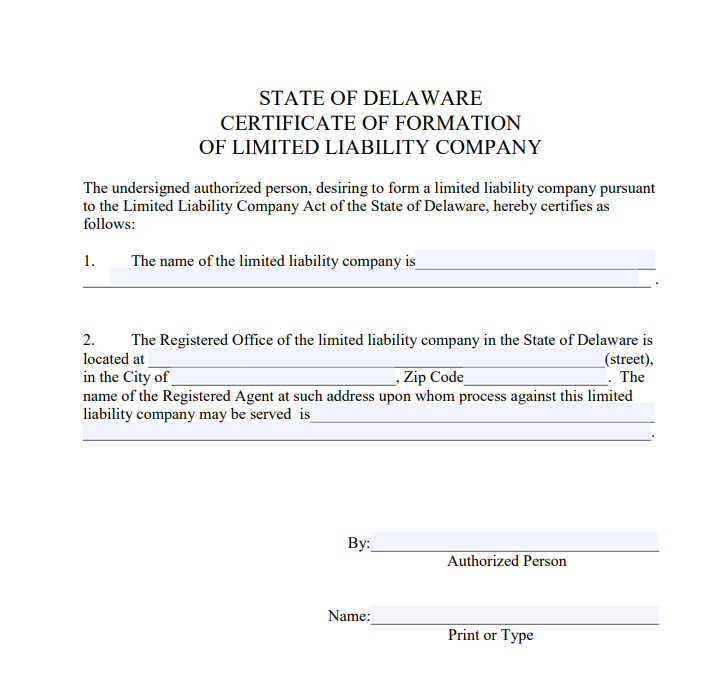

To register an LLC in Delaware, you have to fill in and submit a Certificate of Formation to the Division of Corporations. If you use an incorporation service, they will fill in the form for you and submit it to the government on your behalf.

That said, here is the standard template for a Delaware Certificate of Formation for a traditional LLC:

For your information, a Certificate of Formation for an LLC in Delaware must include 2 pieces of information:

- The name of your limited liability company in Delaware.

- The name and address of the registered agent of your Delaware LLC.

You can add additional information to the Certificate as you wish.

If you wish to apply on your own, you can use the template above to prepare your Certificate of Formation (for a traditional LLC). You can submit this form by uploading the PDF file on the government website, by mail, or by post.

Note: If you aim for a foreign LLC or LLC series (other than a traditional LLC), you need to fill in respective forms. You can find the templates on the government website.

If you send the application by post, it is a good practice for you to include a cover memo along with the Certificate of Formation, for contact purposes. It may contain your name, address, email, and phone number.

Step 3. Receive the Result

After the submission of the Certificate of Formation, you can expect to receive the incorporation result in a couple of weeks. In most cases, the processing time is from 2 to 6 weeks. If you wish to receive the result faster, you will need to pay an additional fee. The faster you need, the higher the fee is.

If the application is approved, you will receive back a stamped Certificate of Formation. The Delaware LLC registration is done. Your company is officially formed in Delaware!

3. Post LLC Registration in Delaware

A Delaware registration is simply not enough to start your business right away. Here are the things you need to do after you register an LLC in Delaware.

Get a Delaware EIN for Your LLC

EIN stands for Employer Identification Number, also known as FTIN (Federal Tax Identification Number). You can think of this number as the identification for your LLC in Delaware, for both entity and tax purposes. An EIN will allow your business to apply for a corporate bank account and employ staff in the U.S.

You can entrust your LLC’s agent to take care of the EIN registration. The registration can be done online via the IRS website or via the submission of form SS-4. You can also do it by yourself, but it would cost you a lot of time.

Apply for Additional Licenses and Permits

Certain industries in the U.S require additional licenses and permits. There are 3 tiers of authority that manage different licenses and permits: federal, state, and local.

At the federal level, you can read this SBA guide to find out what activities need licenses from what agencies. At the state level, you can check out the Delaware index of business licenses. At the local level, you should contact and check with the local authority.

One more thing: if you establish your LLC in Delaware but want to conduct business in another state, you may need certification in that other state to do so. This certification is known as Foreign Qualification. You should do a little research to find out whether you need to obtain this certification in the state where you are about to do business. The process for application varies from state to state.

Design your LLC’s Delaware Operating Agreement

A Delaware Operating Agreement sets forth all matters of an LLC, including business structure, general rules, management, and operation. The agreement can come under a written or oral form. Your LLC does not need to file this document with any department of Delaware.

However, in order to keep everything in order and control, there has to be a written Operating Agreement, which is kept internally in the company. Every member must sign the agreement before joining the business.

As the initial owner, you can create your own Delaware Operating Agreement. You may consult professionals or go over some online templates to get the outline. Generally, a Delaware Operating Agreement should include the following sections:

- Organization establishment and ownership

- Management

- Duties and rights

- Capital matters

- Distribution of profits and losses

- Membership change

- Company dissolution

Open a Bank Account for Your Delaware LLC

Getting a corporate bank account is the best way to separate your personal assets from the company’s assets. An LLC in Delaware is allowed to open a bank account in another country.

For non-residents of the U.S., it is not an easy task to apply for a corporate bank account with banks in Delaware or the U.S. It is advisable that you should open a corporate account in your home country or the place where the business is conducted.

Stay Compliant with the Local Laws

To maintain good standing at the state level, your Delaware LLC needs to comply with two main requirements. They are:

- Maintaining a registered agent in Delaware, and

- Paying an annual fixed tax in Delaware.

Furthermore, if you register a multiple-member LLC in Delaware and earn income within the state, then the company needs to file a return with the Division of Revenue in Delaware. Individual members will then need to file personal income tax returns to the Division on the income attributable from the LLC.

At the federal level, your LLC in Delaware and its members also need to file respective forms to the IRS.

4. Conclusion

To register an LLC in Delaware, you only need to submit a Certificate of Formation to the Delaware Division of Corporations. This form must include the name of your LLC and the details of your LLC’s registered agent. The processing time is around 2 – 6 weeks. You are advised to engage an incorporation service to make sure everything flows on the right track.

After the Delaware LLC registration, a few more steps need to be completed. You need to get an EIN, additional licenses (need to check carefully if any), a corporate bank account, and maintain good standing by complying with local laws.

BBCIncorp can help with your LLC registration in Delaware. We will take care of all the work for you! Contact us now!

.webp)

0 Comments