Starting a business in Singapore is simply one of the best decisions that you can make. The country has been listed as one of the top places to do business in the world, for a very long time.

As a foreigner, you need to register a company and open a bank account to kick-start your business in Singapore. Keep on reading as we will list down the step-by-step process of how to do so.

1. Benefits of Starting a Business in Singapore

According to Doing Business 2020 conducted by The World Bank, Singapore secured its second place in the list of countries that are the easiest for doing business. The Lion City has impressively maintained the top ranking for many consecutive years.

Indeed, Singapore has attracted a great number of foreign entrepreneurs and businesses to come and invest, due to a wide range of advantages that the country can offer, including:

- Ease of company formation (you can open your Singapore company completely online and the process normally can be done within 24 hours)

- Favorable tax system (you can benefit from not only the low tax rates but also many beneficial schemes that can help your company legally lower the payable tax)

- Singapore strategic locations and its modern infrastructure system

- Highly-qualified workforce and great living standard

- Opening immigration policy

- Excellent intellectual property regime

2. How to Start a Business in Singapore as a Foreigner

If you are a non-resident, there are 2 things that you need to do to quickly start a business in Singapore:

- Register a local company

- Open a corporate bank account

2.1. How to Set up a Company in Singapore

Here is the 6-step procedure to set up a company in Singapore for foreigners:

Step 1. Pick the Type of Business Entity

There are many types of business entities in Singapore from which you can choose. Some of the most common ones are listed below:

- Sole proprietorship

- Limited liability company

- General partnership

- Limited partnership

- Limited liability partnership

If you are still wondering what type to choose, the advice is to go for a private limited company. It is the company that is owned by a maximum of 50 shareholders. In general, this type of company can bring you more benefits than other types of business:

- It is considered a separate legal entity.

- Its members have only limited liability. This means you, as a shareholder, will not hold any liability that goes beyond your owned share.

- It can be eligible for a tax exemption of 75% and other exclusive tax schemes and grants.

- You will not be taxed on dividends distributed from the company.

Step 2. Choose the Name of Your Company

The next thing to do is name your company. Here are some guidelines for you:

- The name must be unique, meaning not the same or too identical to other existing ones.

- The name should not contain any offensive meaning or sensitive words.

- The name should not imply any connection with the government agencies.

If your proposed name satisfies all the conditions, you are good to go!

Step 3. Use a Service for Singapore Company Registration

If you are a foreigner and want to register a company in Singapore, you must engage in an incorporation service of professionals. This is a statement from the Accounting and Corporate Regulatory Authority (ACRA), the government agency that oversees all the business registration in Singapore.

A service can easily help you cover all the incorporation requirements. In particular, to register a local company, you will need to fulfill the following:

- Having a director who locally stays in Singapore

- Having a local registered office address in Singapore

- Having a secretary within 6 months after the incorporation

- Having an auditor within 3 months after the incorporation

BBCIncorp has multiple incorporation packages that can meet all of your needs. Our Basic package ($675 for the cost) is highly recommended for Singapore local startups.

Our Standard package ($1950) is uniquely designed for foreign entrepreneurs and investors. We provide you with a nominee director, a secretary, and a local address for your company. We also take on the company registration process with ACRA so you don’t need to do any of the hard work. And if you are seeking Singapore work pass application, exploring our Premium package ($1985) to save your money as you can obtain both what we provide in our standard package with employment pass. We will proceed to help you apply for a work pass so that you can move to Singapore and directly manage your company.

Remarkably, we offer free support for your bank account opening with Singapore banks in all three packages.

As for an auditor, you do not have to appoint one as long as your Singapore company is considered a small one (no more than $10mil of annual revenue and no more than 50 employees).

Step 4. Make a Payment

If you decide to use our services, the next step is to pay for the chosen incorporation package. You can pay directly on our website via Paypal or Stripe or bank transfer. Once the payment is made, our staff will reach out to you for order confirmation on the same day.

Step 5. Follow the KYC Procedure

Complying with the know-your-customer (KYC) procedure, our employees will ask you to supply some documents and information for the company registration. Here are what we need from you:

- The proposed name of your company

- The details of your company’s business activities

- Certified copies of all members and shareholders of the company

Once we get everything needed from you, we will proceed to file an application and submit it to ACRA.

Step 6. Get the Result

You can expect to receive a digital certificate of incorporation in just 24 hours. However, the processing time may be extended to a few days if the government needs more time to process your application.

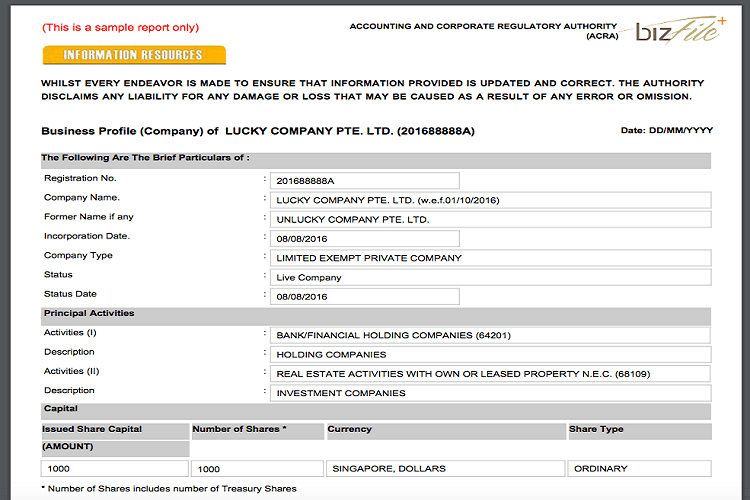

At this point, your new company will have been successfully formed in Singapore. You will receive an email, attached in which are the certificate of incorporation and a business profile. The profile includes the essential information of your company.

2.2. How to Apply for a Bank Account

To start a business in Singapore, you will need to further open a bank account. Your company needs one to transact with customers, partners, and even the government. It is also the best way to protect your personal assets, since the company’s money is stored separately in its own account.

Singapore has one of the banking systems in the world, with the presence of many large and reputable banks. A corporate account with Singapore banks can enhance your business image by a lot.

Although the application processes of many banks are quite alike, each bank has a different set of conditions for approval. If you are a foreigner, it is really hard for you to apply on your own. The advice is to go for a banking service.

BBCIncorp can help you on this matter. We have successfully assisted many new companies in Singapore to open their corporate accounts. Here is the procedure to apply for a bank account if you work with us:

- Consult our staff to pick the most suitable bank and know about the application process

- Make a payment (if you place a separate order for our banking service)

- Supply certain required documents

- File and submit the application (we handle this step)

- Go on an interview with the bank if your application is approved (we will make an appointment for you)

For an application, you will need to provide us with the following:

- The corporate documents (the certificate of incorporation)

- The address proof (passports) of all the company’s members

- Bank reference letter and statements

- Business proof (business contracts, agreements, invoices, etc.)

If the interview finishes well, you can expect your corporate account to be opened in a couple of weeks. Please note that the decision is solely made by the bank. We can not guarantee a success rate of 100%.

Basically, having your company and bank account opened is enough for you to begin your business in Singapore. If your company operates in certain activities that require additional licenses, you need to apply and obtain them before starting your business.

.webp)

0 Comments