Part 1: Top 5 countries with no income tax

3. Low-tax countries with the territorial tax system

When incorporating in no-tax countries, you will need to prepare yourself to deal with their uncertainty. For instance, if you had incorporated in Belize or BVI, you would now have to deal with their new Economic Substance Requirements.

More and more of these jurisdictions are changing their tax policies to fit the global standard. Particularly, they are adding more regulations and taxes on certain kinds of income. It is reasonable to predict that tax-free countries will no longer exist in the near future.

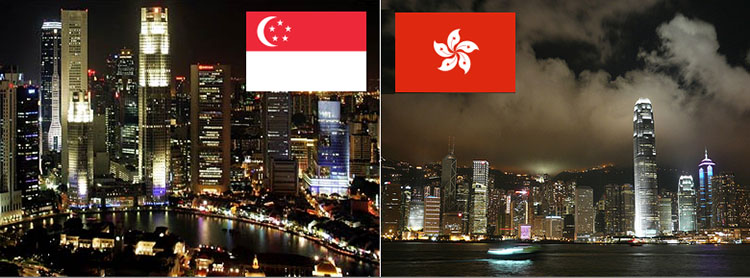

To avoid instability, you may want to reconsider your choice to certain low-tax jurisdictions. These places can guarantee you a much higher degree of stability and reputation. Hong Kong and Singapore are the 2 shining names for your consideration. They are ranked in the top 3 countries in regard to the Ease of Doing Business category, according to the Doing Business 2020 report.

Hong Kong

Hong Kong follows the territorial tax system. It means only the income generated in Hong Kong is taxed. The income generated outside of this jurisdiction, on the other hand, is not. There is also no dividend tax, no capital gain tax, no goods and services tax.

If your company is opened in Hong Kong, but carries out all activities in other foreign countries, it can be granted an offshore tax exemption. No tax needs to be paid in this situation.

As for income arising in Hong Kong, the corporate tax rates are only 8.25% (for the first 2 million HKD) and 16.5% (for the rest of the income).

Singapore

Singapore also follows the territorial tax system. For income arising in this country, the corporate tax rate is 17%.

The foreign income, meaning generated in other countries, is tax-free. It can be subject to tax but only when being remitted into Singapore. Your company can still be exempted from foreign income tax when satisfying certain conditions.

Additionally, your company can apply for the tax exemption scheme for new start-ups (subject to certain conditions). The benefits are 75% tax exemption on the first 100,000 SGD and another 50% tax exemption on the next 100,000 SGD. The scheme will apply to the first 3 years of incorporation.

From the 4th year, your company is automatically eligible for the partial exemption scheme (no conditions to be met). The benefits are 75% tax exemption on the first 10,000 SGD and another 50% tax exemption on the next 190,000 SGD.

4. The bottom line

There are many countries with no income tax which can be taken into account: UAE, Bermuda, Bahamas, Saint Kitts, and Nevis, and the Cayman Islands. But please note that asking for a permanent residence for tax purposes is easier to say than to do.

Some countries with no income tax are quite difficult to access. Spending time on careful planning and preparing a large amount of money for investment or company establishment is of vital importance in most cases. You are advised to engage professional experts before moving.

Still, there is another solution that is to pick low-tax jurisdictions with territorial regimes as we mentioned in the first part. Hong Kong and Singapore are not only premium financial and business hubs in Asia but also have more accessible opportunities for income tax optimization.

Should you need more questions and want to chat with our experts, do not hesitate to drop us a message or email us via service@bbcincorp.com

.webp)

0 Comments